By ZAIDI ISHAM ISMAIL

editor@dagangnews.com

KUALA LUMPUR Dec 27 - The year has been traumatic as the country grapples with a pandemic and finishes of 2021 with the worst floods in 50 years.

However, life in the corporate world goes on and here are some of the developments at the corporate front which might pique the interests of investors and the rakyat in 2022.

Roller coaster ride for the rubber glove makers

The rubber glove companies saw mixed fortunes of sorts in 2021.

At the peak of COVID-19, demand skyrocketed and earnings breached the RM1 billion mark.

Then its income dipped with the arrival of the vaccines.

And now, Omicron rears its ugly head and the fortunes of the glovemakers such as Top Glove and Supermax are on the rise again.

Similarly, 2022 will be a choppy ride for the companies until the virus is nipped in the bud.

AirAsia X to refund its passengers?

Passengers bade for their refunds from AirAsia X for the most part of the year.

It is likely that this issue will protract next year and may even spill over to AirAsia Bhd. Will the passengers be refunded fully? The drama continues.

Redemption for Serba Dinamik?

The oil and gas outfit had skirmishes with its former auditor KPMG and subsequently Bursa Malaysia.

Will its shares be allowed to trade again? The battle continues.

IPOs continue to thrive

Despite a tumultuous year, the initial public offerings (IPOs) market is expected to continue its momentum next year.

A total of 25 companies spearheaded by Farm Fresh and Seng Heng are expected to be listed next year bucking the lacklustre stock market.

Ecommerce to soar higher?

There is no denying that the online shopping, food delivery and logistics sector raked in stratospheric profits last year and this year.

At the rate it is going, as well as the emergence of new variants, the e-shopping sector is headed for a record year next year.

Pos Malaysia to chalk in profits?

The national postal company has been loss making for the large part of the last ten years.

Will the arrival of a new chief executive officer revive its fortunes? Keep delivering the goods and the company will be okay.

Palm oil to break RM5,000 a tonne record high?

Crude palm oil prices breached the RM5,000 a tonne mark this year, its highest ever.

Will the commodity continue to rise on the back of burgeoning demand? Only time will tell.

Exports continue its mean streak

Not many people realise that despite 1 million Malaysians losing their jobs, the ports are bustling managing our exports.

Exports of goods have been a safety net for the economy enabling the country to register economic growth.

Crane and gantry operators are expected to be busy next year lifting the containers onto ships.

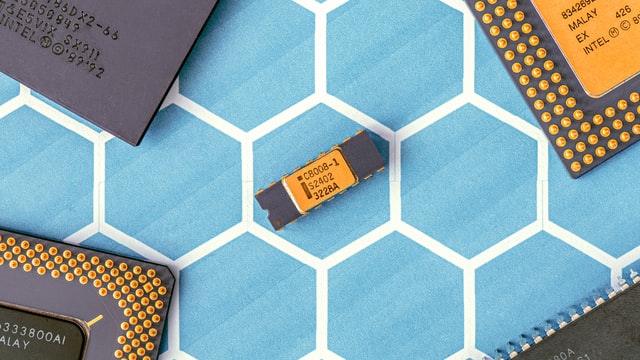

Semiconductor shortage set to persist

The semiconductor industry thrived for the past two years as lockdowns forced the rakyat to stay home.

Due to this new normal, sales of laptops, phones and tablets surged as the rakyat work from home, hold online meetings and sell online.

Although the pandemic has eased somewhat, this sector is expected to remain robust next year.

Oil prices to scratch new highs?

Black gold made a comeback this year breaching the US$70 per barrel after being in the doldrums last year.

Will it hold the trend next year in the face of the energy efficient electric car? The race has begun.

Economy expected to hold

Malaysia's economy as forecasted by the World Bank is expected to hover at between 3-5 percent next year.

For as long as the rakyat continue to spend, exports remain robust and commodity prices remain firm, Malaysia' economic and corporate outlook remains challenging next year. - DagangNews.com