DagangNews.com

DagangNews.comKLCE AND CPO FUTURES: SUCCESS STORIES OF MALAYSIAN DERIVATIVES

TO BEGIN WITH, let us congratulate Bursa Malaysia that has been named as THE BEST STOCK EXCHANGE FOR ISLAMIC LISTING 2020 for second consecutive year! As we are focusing on investments of syariah shares on Bursa Malaysia, we are indeed very proud that Bursa Malaysia has been recognised globally by Islamic Finance News as reported by DagangNews.com!

OK back to school! Again I have a question raised by a regular visitor of DagangNews.com about Bursa Malaysia Derivatives as stated in my last article. I understand that many of us know the very popular and glamour Bursa Malaysia only. He admits that Bursa Malaysia Derivatives is rather very unfamiliar market to trade with, even in Malaysia because of the word `derivatives'!

Bursa Malaysia Securities vs Bursa Malaysia Derivatives

Then allow me to clarify it. On one note, Bursa Malaysia’s full name is Bursa Malaysia Securities Berhad. As the name may suggest, it trades all securities in Malaysia such as shares, warrants, rights and bonds. Bursa Malaysia Derivatives Berhad, on the other note, as the name may imply, it trades all derivatives such as crude palm oil futures, index futures, interest rate futures, bond futures and gold futures as well as index options. Both exchanges are wholly owned by Bursa Malaysia Group Berhad.

As a matter of fact, futures come from the word `future' in which a contract signed today must be fulfilled at a future date known as maturity date. Generally or specifically any contract must have a maturity date. Maturity has a life as short as one month to as long as five years on Bursa Malaysia Derivatives. Therefore many investors in the stock market are very skeptical on the fulfillment of the contract in the future: "Is there any future of the futures trading in Malaysia?

Moving forward, the word `derivative' originates from the word `derive'. As such, the performance of derivatives market is derived from the performance of its underlying market; the cash market. By trading procedure, the cash market refers to the `spot' market in which it must be settled immediately; while derivative market refers to `delayed' market in which it may be settled at a later date. So a contract can be offset simply by taking opposite positions: buy close out with sell and sell close out with buy before its maturity!

Kuala Lumpur Commodity Exchange (KLCE)

This week we will focus on crude palm oil (CPO) futures as it was the first derivative instrument to be traded in Malaysia with the launching of CPO futures on KLCE in October 1980. Interestingly, KLCE was the first multi-commodities market in South East Asia with the introduction of rubber futures in 1984 and tin futures in 1985.

In essence, we are talking about Malaysian natural resources that Malaysia used to be the biggest producer and exporter of palm oil, rubber and tin. Therefore, since 1980, CPO, rubber and tin futures are available for trading on KLCE. However, rubber and tin futures were dying due to severe competitions with synthetic rubber and aluminium, respectively, in which their respective futures prices are diverted to elite international commodity markets.

Since Malaysia is still number one producer of natural rubber in the world, Malaysia Standard Rubber (MSR) prices are compiled by Malaysia Rubber Board (MRB) for local cash-delivered market. Internationally, MSR are traded at Tokyo Commodity Exchange and Shanghai Futures Exchange. It is coded under the name of TSR Futures (natural rubber) as opposed to RSS Futures (synthetic rubber).

However, during pandemic COVID-19, the demand for rubber gloves surged that led to record rising market prices of glove counters notably Top Glove, Hartalega, Supermax and Kossan since June 2020 as documented in Article 12. Following suit, the prices of natural rubber rise steadily from low of RM4.00 per kg in 2019 to RM5.70 in late September 2020 from its high of RM17.17 per kg in 2011!

For tin, its golden age came to an end since late 1980s as tin production ceased to exist. Due to this closure, many mining land began to be converted into commercial and residential projects. Like rubber, Kuala Lumpur Tin Market (KLTM) is responsible to compile cash-delivered prices of tin for domestic market. For tin futures prices, price references are diverted to London Metal Exchange (LME).

However, there is a call by PH government to revive tin mining as the tin prices fetching about US$20,000 per tonne in April 2019. As at 28 September 2020, the reference futures prices of tin traded at LME is US$17,035 while cash prices at KLTM is US$16,650. Both cash and futures markets are moving downtrends since early September 2020, implying its volatility!

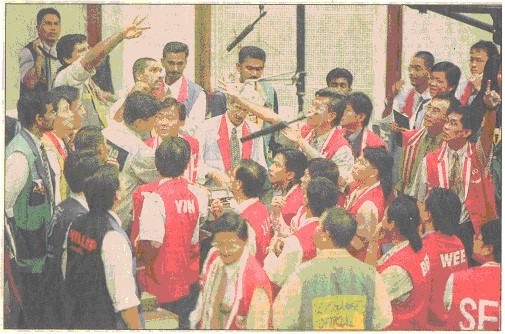

As a testimony of success stories of CPO, in 2009, BMDB via its holding, Bursa Malaysia Group has engaged a partnership with Chicago Mercantile Exchange (CME). Via its CME Group, CME has become the biggest derivative markets in the world to be accessible to the global trading of CPO futures. Like NYSE as the biggest stock market in the world, both NYSE and CME are still using their trading floor instead of electronic trading. Therefore, both exchanges have representatives on the trading floor with designated colourful vests using hand signals as in the case of KLCE as illustrated by the above photo!

What are commodities?

Commodities are very broad as they readily bought and sold in the markets, depending on their respective types and features. As we refer commodities to natural resources produced by countries in the world, as in the case of palm oil, rubber and tin. A commodity simply refers to whatever the land can produce; be it by means of growing, raising or extracting.

Growing on the land refers to agricultural (agro-based) products, raising on the land refers to animals (livestock) products, while extracting refers to precious metals (mineral-based) products, which are in fact the natural resources produced by a particular country either for consumption or export.

Commodity as an agro-based products, we focus on oil palm as point of reference for trading purposes in the cash and derivative markets. In addition, palm oil as a commodity has a storage value, implying that palm oil can be delivered physically at maturity date by a buyer of CPO futures. The other factor is the fact that oil palm has many by-products such as crude palm oil, refined palm oil and palm kernel oil, as compared to other agricultural produces and other edible oil products. More important, crude palm oil futures have elements of shariah-compliant securities, notably buying CPO futures.

Palm Oil Industry

Malaysia is the number two producer of global palm oil after Indonesia but remains number one exporter. Palm oil is one of the 14 edible oils in the world, competing closely to its main rival, soybean oil, followed notably by vegetable, corn, sunflower, and rapeseed oils. However, only palm oil and soybean have become a global benchmark for edible oil price references and risk management.

Malaysian government is very committed to develop and promote palm oil products with the establishments of Malaysian Palm Oil Board (MPOB) and Malaysian Palm Oil Council (MPOC). The former is responsible on licensing and researching, while the latter promoting palm oil either expanding in the existing traditional markets or embarking in the new markets. The traditional exporters of Malaysian crude palm oil (CPO) are normally populous countries; namely India, China and Pakistan, also Middle East countries as well as Europe Union countries and Russia.

Statistically, Malaysia produced about 20 million tonnes and exported about 12 million tonnes, with average price of RM2,119 per tonne of palm oil in 2019. Palm oil prices began to slide further in 2019 when India as the biggest importer of Malaysian palm oil put a temporary ban on tariff due to the strain diplomatic ties over Kashmir issue from RM2,235 per tonne in 2018 dropped to RM2,119 in 2019. However, palm oil is still the largest agricultural contributor to Malaysia's gross domestic product (GDP) since 1980 with a total of RM44. 8 billion or 3.8% contribution in 2017.

CPO Prices

Malaysian palm oil as an agro-based commodity is vulnerable to price fluctuations over the years, hence making palm oil prices very volatile. For instance, lowest prices of CPO were recorded about RM580 in 1986 while the highest prices fetched about RM3,950 in 2008. CPO prices began to recover significantly when the Indonesian and Malaysian governments imposed Bio30 and Bio20 on the usage of CPO in January 2020, respectively, pushing its average prices to RM3,400 per MT.

Unfortunately, the palm oil prices along with crude petroleum prices were subject to adverse falls since the rising global outbreak of COVID-19, pushing down global benchmark Malaysian crude palm oil to low at below RM2,500 per MT and global benchmark Brent crude oil to low at below USD30 per barrel in third week of March 2020. However, CPO prices began to improve as its prices are surpassing RM3,000 per MT since mid September 2020, benefiting major plantation companies such as IOI, KLK, Sime Darby Plantation and United Plantation.

Does CPO futures meet Syariah rules?

As justified the above, the trading of palm oil futures on the Bursa Malaysia Derivatives Berhad (BMDB) is seen to meet shariah principles. As noted earlier, the price of CPO futures are derived from the actual price of physical CPO as compiled by MPOB. These cash and futures may influence each other on CPO as a commodity, either trading at premium (futures greater than cash prices) or at discount (futures smaller than cash prices), in which cash prices are managed by MPOB as the cash-delivered market while futures prices are regulated by BMDB as futures market.

BMDB as the derivative market will provide price discovery for the market players to have their consensus today on the prices in the forward months. The price discovery will provide the futures price in the spot (current) month and forward months. This is justifiable as CPO futures are contracts in which every contract must have its maturity date, the date that every market participant is obligated to his contract.

Generally, participants of CPO futures markets are the hedgers and speculators. Hedgers are the owners of physical CPO; be it the palm oil producers (suppliers or sellers) or refiners (users or buyers); while speculators are not the owners of physical CPO. Speculators do not have any intention to own physical CPO but they function as the market-makers to take the price risks to be transferred by the owners of CPO. They enter into the market either by buying or selling CPO futures hoping to make profit by offsetting their positions.

Though speculators do provide liquidity to the market, their speculative activities are seen not to meet the strict syariah rules. Next week we will talk about the mechanics of CPO futures trading as leveraged investments to testify that they are syariah compliant!

The writer is a former investment professor at UiTM, retired in 2016, a Fulbright fellow since 2011 and a principal research fellow since June 2020