KUALA LUMPUR Jan 26 – Almost all companies which have big dreams aspire to list on Bursa Malaysia.

Stock exchanges are considered to be the ivy leagues for all the top companies in the world.

In Malaysia, the creme de la creme among the country's top corporates float a portion of their shares on Bursa Malaysia to share a slice of their profit pie with investors.

Thus it is heartening to note that despite the pandemic still lurking around the corner, an estimated 25 companies are expected to list on Bursa Malaysia in 2022.

This is pretty courageous of the directors of the companies to list at a time when the stock market is weak and uncertain due to the pandemic.

With this in mind, firms which plan to make it big must plan on one key element - the timing of its IPO or initial public offering.

Consequently, it was disheartening to see the listing of the country's top retailer of electrical and electronic products Sengheng New Retail Bhd on Jan 24.

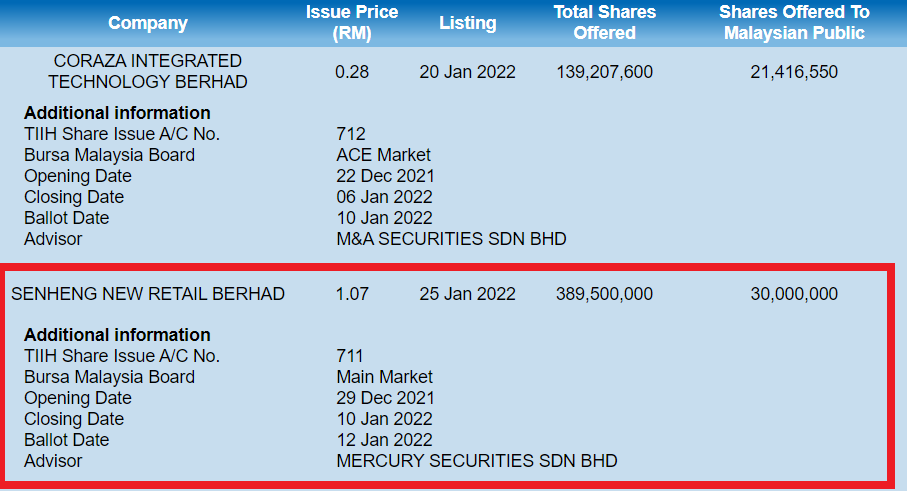

The company's maiden trading day fell flat on its face when its shares dived to 80 sen or 20 percent below its IPO price of RM1.07.

Compare this with the IPO of Coraza Integrated Technology Bhd last week which shot up to 70 sen from its debut price of 20 sen.

"Sengheng's IPO is the worst I've seen among all the IPOs since last year. I pity all the small market traders," trader Nor Hamidy Yusoff told DagangNews.com.

He added among all the 20 IPOs last year, Senheng could be the only IPO which tanked.

Why list at this time?

As an average trader, one might wonder. Why do companies choose to list at the worst time of the year?

Firstly, it must be noted that firms go for listing to raise money from investors to fund its expansion.

To be fair to Sengheng, it needed the RM200 million raised from the IPO to fund its regional expansion.

In a virtual press conference with the press, Senheng executive chairman Lim Kim Heng said : "If you look at the global business environment, it seems like our timing is not very right and, of course, we cannot demand a premium valuation.

“But the fundamentals of our business are on the right track. We will be announcing our fourth-quarter results next month and we hope that our investors will be happy.

''Our focus for the next two to three years will remain on growing revenue, net profit and the return," said Lim.

The writings are already on the wall

Before going for listing, companies must look at the writings which are already on the wall.

"In the case of Senheng, it puzzles me why it wants to go for listing at a time when consumer demand is weak.

The company decided to list anyway even though the rakyat's purchasing for electrical products might not be strong.

The writings are already on the wall," an analyst from Maybank Securities told DagangNews.com.

He said such a scenario would not impact big institutional investors such as the EPF, PNB and KWAP which have deep pockets.

But for small traders with investments of below RM20,000, the price crash would have wiped out thousands of ringgit off their plate," said the analyst.

He added that Coraza Integrated on the other hand planned the timing of its IPO well because it knows that even though COVID-19 is still around, there are clients looking for its products despite the difficult time.

Small traders must not despair

For small-time punters who lost thousands of ringgit due to Senheng's share dive, do not despair.

Unless traders cash out their investments, this is just a paper loss.

So keep holding on to the shares as prices are bound to rebound over time.

It is the companies prerogative to decide on when to time their IPOs but bear in mind that if small time investors lose the first trading day, it will be negative publicity for the firms and may affect its image in the long run.

And for the small traders which may be small in numbers, they still command a significant weightage on the stock market with a combined market capitalisation of billions of ringgit.

They should do their homework and not be bitten again because in 2022 alone, several more IPOs are coming which include Farm Fresh to name a few.

Yes, it is true that Bursa Malaysia is a place where companies can raise money by selling their shares to the rakyat.

But at the same time, it is also a marketplace where investors hope and dream to make it big.

Towards that end, companies should at least study market sentiments before going for listing as to not disappoint their investors.

The hopes and dreams of their investors, big and small, depend on it. – DagangNews.com