KUALA LUMPUR May 9 – Bank Negara Malaysia (BNM) has played an important role in maintaining the country’s economic momentum, including curbing inflation despite the current global economic uncertainties, said Juwai IQI Chief Economist, Shan Saeed.

In the recent report published by BNM, Shan said, it has clearly stated that central bank has got monetary policy tools to maintain price stability in the economy.

“In my opinion, BNM has played a pivotal role in maintaining momentum in the economy and meeting its mandate of price stability.

“However the global economic outlook is heading for stagflation due to COVID-19 challenges, oil shock, increased demand, geo political risk and above all supply constraints.

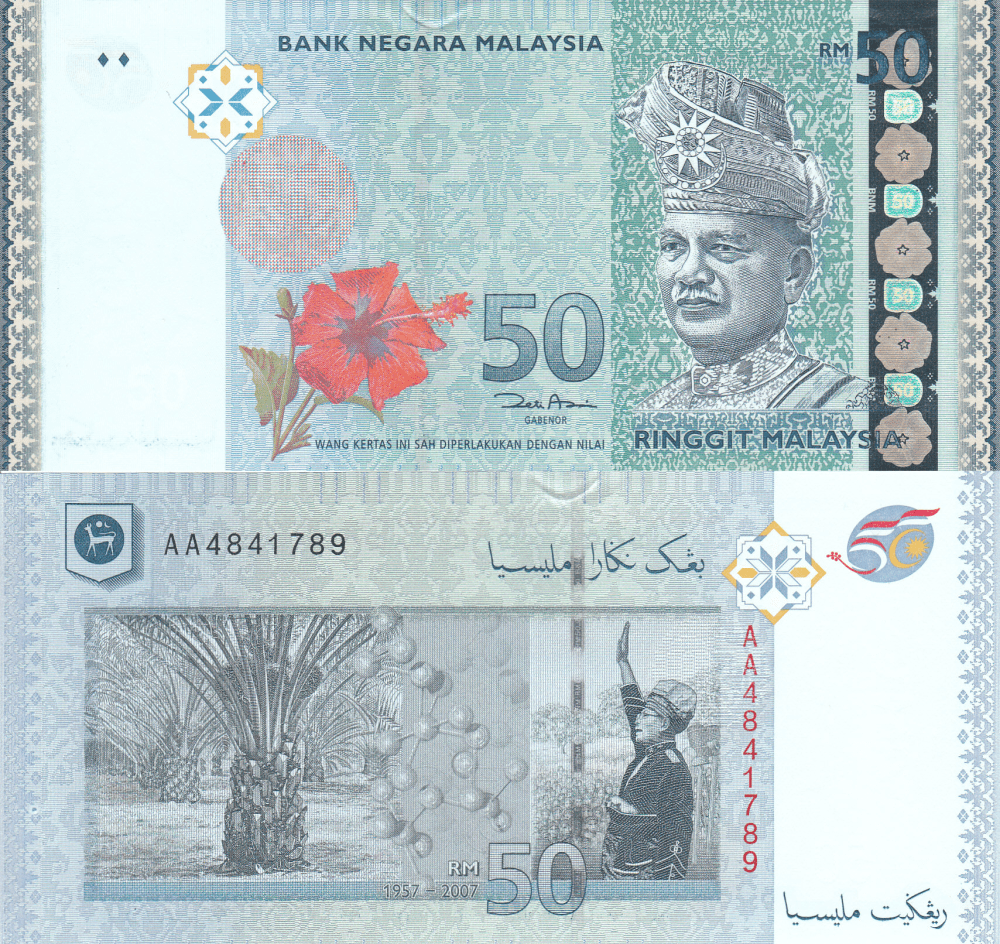

“These challenges are putting risk for all economies at the macro level. The question is does BNM have policy lever to curb inflation or will the ringgit slide further due to stronger dollar in the second quarter? Shan questioned.

He told DagangNews.com today when responding to the current appreciation of the US dollar against a basket of currencies.

According to Shan, BNM has got policy tools to respond to inflation at the macro level.

At a discount rate 1.75 percent, BNM will wait for economy to get into momentum before raising rates.

“It’s a massive trade-off between raising rates and using ringgit appreciation to control price inflation. In my opinion, exchange rate tool is more effective to implement at the tactical level to provide relief in the short run but raising discount rate is a strategic move to bring the prices down in the long run.

“BNM will continue to play its cards according to market requirement and expectation of advanced economies central banks moves for their economies,” he explained.

Ringgit to Dollar outlook - Confidence to bounce back

Noting that the ringgit has made slide due to dollar appreciation in the last 39 days, Shan said the dollar index is up 6.8% year-to-date and will increase further.

However stronger dollar is not sustainable as the U.S. Federal Reserve (FED) aims to control inflation has taken a different turn.

Dollar is going to depreciate by Q3 and maintains its fair value of 95 to 98 against basket of currencies.

Shan said BNM is monitoring the dollar movement, yuan and other ASEAN currencies.

He said BNM cannot allow the ringgit to appreciate too much as it is going to impact trade and commerce outlook.

Shan said the ringgit is expected to hover between 4.25 to 4.50 in the short run, while the year-end movement should meander around 4.10 to 4.20.

This are based on the premise of higher oil prices, higher palm oil prices, strong manufacturing growth, solid foreign direct investment (FDI) and macroeconomic stability.

“We at IQI Global maintain our stance about GDP outlook between 4 and 5% for the currency fiscal year,”he added. – DagangNews.com