KUALA LUMPUR Sept 28 - The oil palm plantations sector was severely hit by COVID-19 which saw an acute shortage of foreign workers.

Due to the closure of international borders and the movement control order many thousands of foreign workers were left stranded at the frontiers.

Indonesian workers for example were sent home or prevented from re-entering Malaysia to curb the spread of the disease.

It is hard to determine how many workers are left stranded and refused to return to work.

But the Malaysian Palm Oil Board estimates the figure at anything between 20,000 to 30,000 workers.

This has obviously strained the operations of many plantation firms which depend 80-90 percent of its oil palm operations to foreign workers.

To aggravate the situations, locals just refuse to work at oil palm estates shunning it as difficult, dirty or dangerous or the 3D.

"The palm oil sector is in dire need of workers to sustain operations," Datuk Dr Ahmad Ibrahim told DagangNews.

The professor at the Tan Sri Omar Centre for STI Policy, UCSI University said the situation is very crisis and has also affected the construction sector.

Better wages for workers

It is no secret that working at a palm oil plantation can be gruelling and back-breaking.

Salaries however may not commensurate with the work being carried out toiling under the hot sun and torrential rains.

The labour is hard and laborious even for a palm oil estate manager.

Perhaps the plantation giants can pay them better salaries to attract local workers.

The government in turn can help ease the financial burden of companies by giving tax incentives or rebates.

More money for automation

The palm oil industry is a labour-intensive sector requiring workers from almost all aspects of its operations.

These include from planting to harvesting, transporting the fruits to the mill and subsequently oil processing.

The sector is already in the midst of intensifying efforts on automation and modernisation.

Perhaps Budget 2023 could provide further impetus to drive automation forward.

Boost R&D activities

Although Malaysia is no longer the world's largest palm oil producer, the country however leads in palm oil-based research and development activities.

The Malaysian Palm Oil Board and universities continue to churn R&D findings which include vitamin E or tocotrienols and palm fibre-based car dashboards.

Via R&D and innovation, Malaysia will be able to earn more income compared to just selling cooking oil.

Perhaps Budget 2023 can grant more R&D grants to produce the country's first palm oil-based chicken feed to reduce the poultry's sector on imported corn.

Incentives on marketing, advertising and promotional activities

It is no secret that the palm oil sector is under attack from other vegetable oil producers.

Soyabean, rapeseed and other oils have over the decades launched countless attacks on palm oil be it in electronic, print and social media.

They accuse the palm oil sector of destroying the orangutan habitats and cut down natural forests.

Perhaps under Budget 2023, the government can allocate more budget to counter these unfounded allegations

Finetune biodiesel facilities

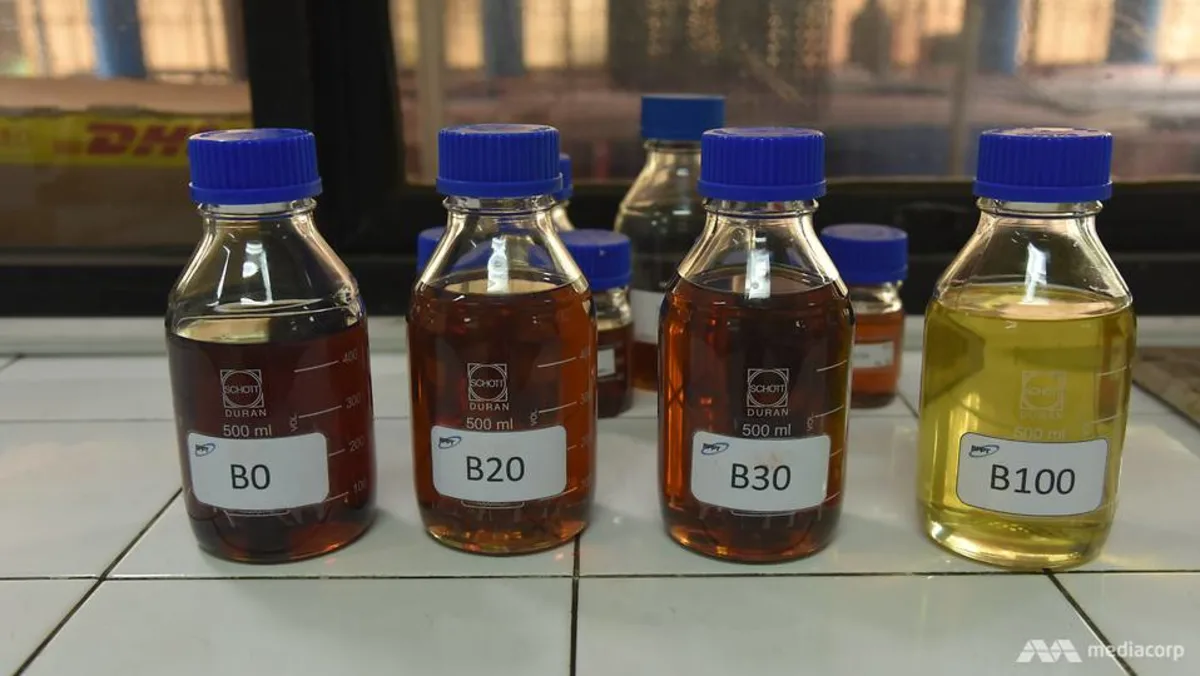

Palm oil-based biodiesel has become a force to be reckoned with in Europe.

European consumers can compare palm-based biodiesel performance with other oils when it is filled in diesel tanks of vehicles in Europe.

But biodiesel for now has to take a backseat as crude palm oil prices are high at RM4,000 a tonne.

But now is the time to improve and fine tune the biodiesel sector and its facilities by giving it more Budget 2024 incentives.

Go easy on the tax

Believe it or not, the plantations sector is the most taxed industry in the country.

This includes export tax, land tax, mill tax, foreign workers levy, corporate tax and others.

Perhaps Budget 2023 could go easy on the sector and allow it to be even more competitive.

After all, palm oil and other commodities bring in over RM100 billion to our coffers and exported all over the world accounting a quarter of the country's gross domestic product.

Prospects look good

With the on-going rains or La Nina, prospects for palm oil looks bright.

Due to heavy rains, workers are unable to work and productivity will dip.

Coupled with the current shortage of workers and La Nina, crude palm oil prices are expected to remain solid for the medium term and Budget 2023 should allocate more funds to maintain the sector's momentum. - DagangNews.com