By MANOKARAN MOTTAIN

MARKET 27-31 Dec 2021

The local stock market continued to rally on continued window dressing activities throughout the week with the KLCI Index ending the week and the year as well +3.36% (51.08 points) at 1,567.53 points.

The market was also helped by solid gains in oil prices (+4.21%) during the week to US$78.98 per barrel for Brent crude as industry data showed a decline in US oil inventories.

Sentiments were also aided by the fact that the outlook for global economies may not be as bad as initially feared as the current wave of Covid infections triggered by the Omicron variant did not result in a spike in fatality rates, therefore reducing the prospects of another wave of global lockdowns.

However, I would like to point out that the gains in the local stock market were achieved on relatively low daily trading value of below RM2.0 billion per day.

Hence, the coming weeks’ performance of the market will be critical as an indicator for its performance for the rest of the year. It will also be interesting to see if the traditional Chinese New Year rally will materialize next year.

In his New Year message, Prime Minister Datuk Seri Ismail Sabri is confident that Malaysia’s economy will grow between 5.5% - 6.5% for 2022, as positive economic & trade indicators have begun to emerge in 4Q21. As such, the government will be focused to implement projects outlined in the 12th Malaysia Plan and strengthen the digital economy to sustain the economic recovery.

In his speech, he reiterated the government’s commitment toward achieving carbon neutral nation status by 2050 and transform the economy and society that cares about Environmental, Social and Governance (ESG). The government will also focus on creating at least 600,000 jobs and fast track the recovery of micro, small and medium sized enterprises.

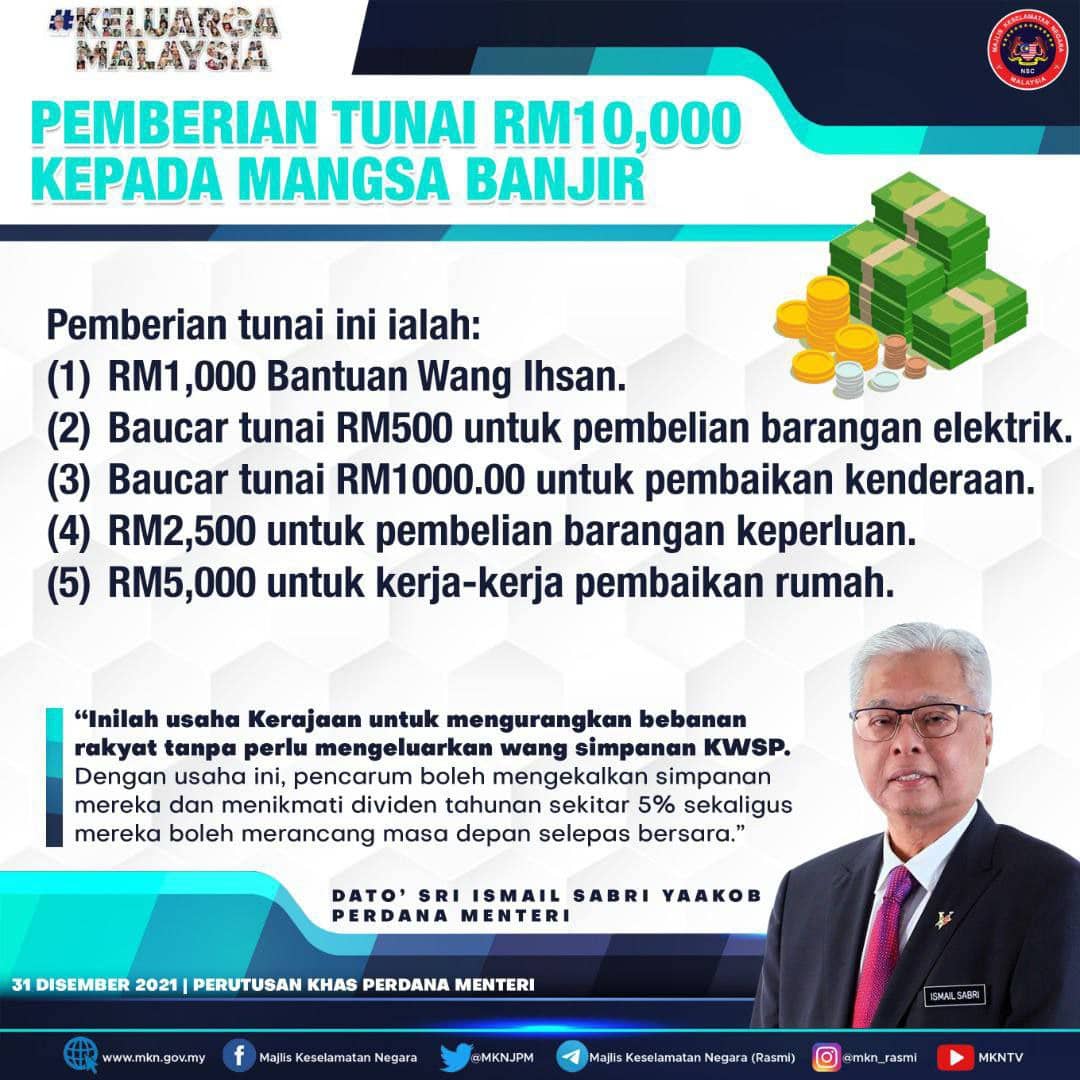

He also announced that cash aid for flood victims by the government have been increased to up to RM10,000 per household and the government will also provide additional cash assistance of up to RM5,000 for households who sustained non serious damages.

The government itself will manage the repairs for households that experienced serious damage up to the tune of RM15,000 per house and up to RM56,000 for the reconstruction of houses for those whose homes had been totally destroyed during the floods.

In response to the rapid spread of Omicron variant, the Health Ministry has decided to accelerate the administration of the booster shots for the Pfizer and AstraZeneca vaccine recipients. They are scheduled to be given their booster shots at least three (3) months after their initial vaccine primer dose.

Meanwhile, Employees Provident Fund (EPF) has warned that any erosion of trust towards the agency as a provident fund and trustee to members’ retirement future may trigger a tidal wave of withdrawals that can negatively impact the local capital markets as EPF is one of the biggest local investors.

EPF disclosed that more than RM270 billion in savings can be withdrawn at any time by its members who have reached the age above 55 and 60 years old or those who have more than RM1.0 million in their account.

ECONOMY

Malaysia’s total trade surpassed the RM2 trillion mark for the first time in history, expanding 24.6% year-on-year (y-o-y) to RM2.01 trillion from January 2021 to November 2021.

The trade value of November 2021 at RM205.5 billion is also the second consecutive month that the monthly trade value exceeded the RM200 billion level and is also the 10th consecutive month of double-digit growth since February 2021.

This is a very positive indicator for Malaysia as it shows that its economy is robust and that its recovery is on track.

Malaysia External Trade Development Cooperation (MATRADE) disclosed that during the period, exports increased by 25.7% y-o-y to RM1.11 trillion while imports rose by 23.3% y-o-y to RM894.42 billion. As a result, the country’s trade surplus gained 36.2% y-o-y to RM221.53 billion.

The gains in exports were underpinned by the manufactured goods segment (electrical and electronic (E&E) products, petroleum products, manufactures of metal, rubber products and chemical products) which grew 25.3% y-o-y to RM961.89 billion.

This is followed by exports of agriculture goods which gained 37.3% y-o-y to RM87.03 billion due to the high Crude Palm Oil (CPO) prices that benefitted the palm oil and palm oil-based agriculture products.

Exports of mining goods (liquefied natural gas (LNG), metalliferous ore, metal scrap and crude petroleum) rose 17.8% y-o-y to RM62.78 billion aided by high crude oil and metal prices.

MATRADE added that exports to major markets – the ASEAN region, China, the United States (US), the European Union (EU) and Japan all recorded double-digit growth in November 2021, with exports to ASEAN and the US registering all-time high figures in terms of value.

Malaysia’s trade with ASEAN, US and China grew by 45.5%, 33.5% and 26.1% on a y-o-y basis to RM56.63 billion, RM13.3 billion and RM37.92 billion respectively. ASEAN, China and US collectively accounted for 55.7% of Malaysia’s total trade in November 2021.

In another sanguine development, Port Klang has handled its highest ever container handling volume as of 28 December 2021 at 13.64 million Twenty-Foot Equivalent Units (TEU). This surpassed its previous record of 13.58 million TEUs handled in 2019. Port Klang is expected to end the year with 13.75 million TEUs, the best ever performance since container operations began in 1973.

The record-breaking container volume was mainly attributed to the commitment and co-ordinated efforts of all the parties involved that includes logistics players, government agencies led by the Port Klang authority and the terminal operators – Northport and Westports. The increased usage of digitalisation has also helped to improve efficiency and overcome operational challenges.

The outlook for 2022 is optimistic as Port Klang is a leading logistics hub in Asia and is set to benefit from the gradual reopening and recovery of the global economy.

CURRENCY

The Ringgit continues to gain against the US Dollar during the week at RM4.1503 / USD1.00 on the back of a rising risk appetite among investors as the US Dollar is traditionally regarded as a safe haven currency.

However, the Ringgit lost a little bit of ground against other key currencies during the week – especially the Singapore Dollar, Euro and the British Pound. I expect the Ringgit to hold steady in the coming week and trade in a tight range of between RM4.15 to RM4.20. – DagangNews.com

Manokaran Mottain has been an economist with a number of financial institutions is now managing his own firm, Rising Success Consultancy Sdn Bhd