DagangNews.com

DagangNews.com

By Erina Azmi

THE time has come for us to look back on the exhilarating time we had in 2020 with our Cryptocurrency Yearly Report!

It was certainly an adventurous journey for the crypto space as we began to see more institutional investors trickling in. Companies such as Square, and Microstrategy have begun to adopt Bitcoin as part of their hedging strategies. In fact, institutional investors now hold a cumulative approximate of 1,172,065 Bitcoins (That's 6% of the current circulating supply!) in their treasuries according to bitcointreasuries.org at the time of writing.

We experienced the rise of Decentralized Finance (DeFi) in the summer which introduced billion-dollar protocols including Uniswap, Curve, Synthetix, and more. Unfortunately, DeFi’s growing popularity also attracted the interest of malicious parties which resulted in exploitations costing $121 million in losses.

It was also a year of bountiful airdrops from Uniswap, 1inch, The Graph, and more.

Are you ready for a blast from the past?

Here are our 5 key crypto-highlights for 2020:

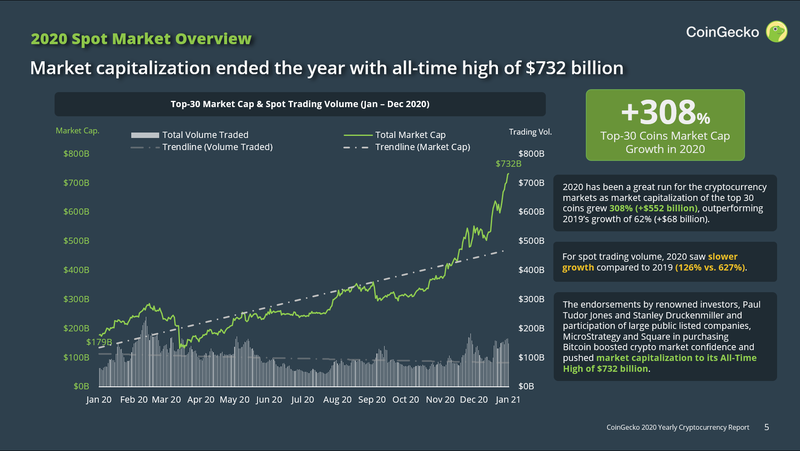

1. The top-30 crypto market cap saw a 308% growth

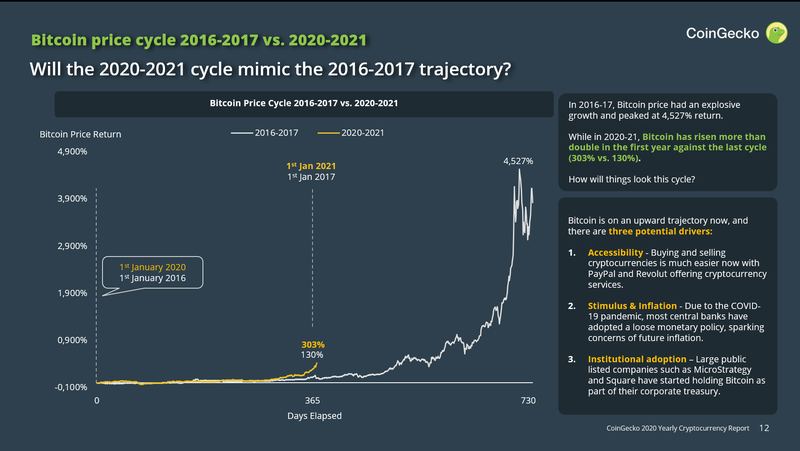

2. The 2020 - 2021 Bitcoin bull run appears to mimic 2016-2017 trajectory

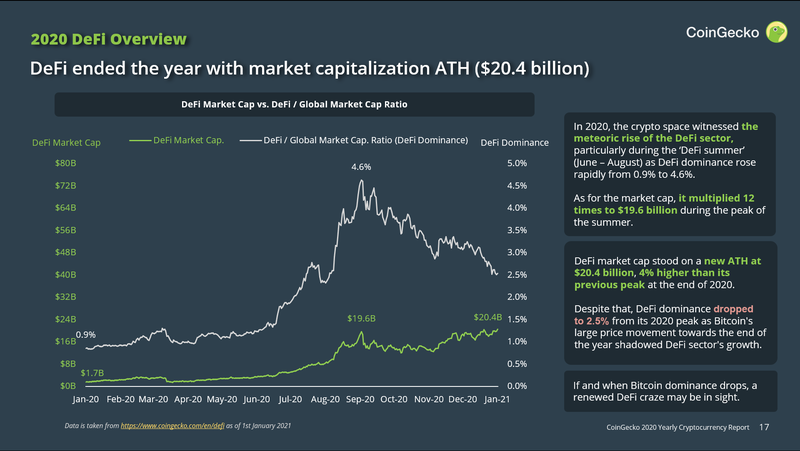

3. DeFi ended the year with an all-time high market cap of $20.4 billion

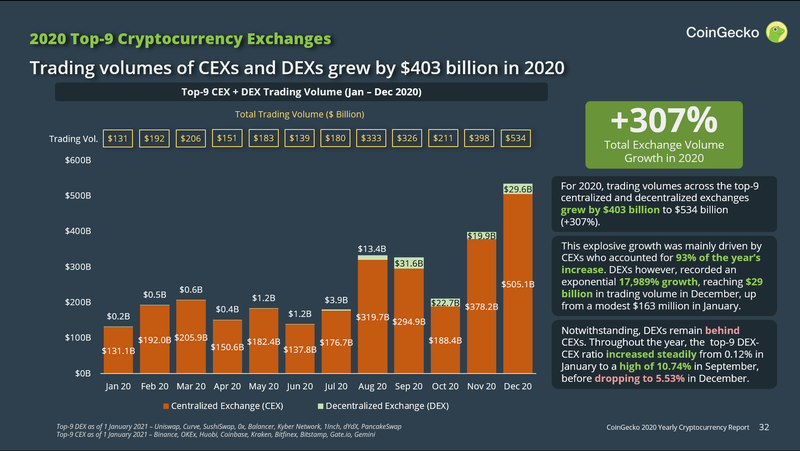

4. Trading volume of CEXs and DEXs grew by $403 billion

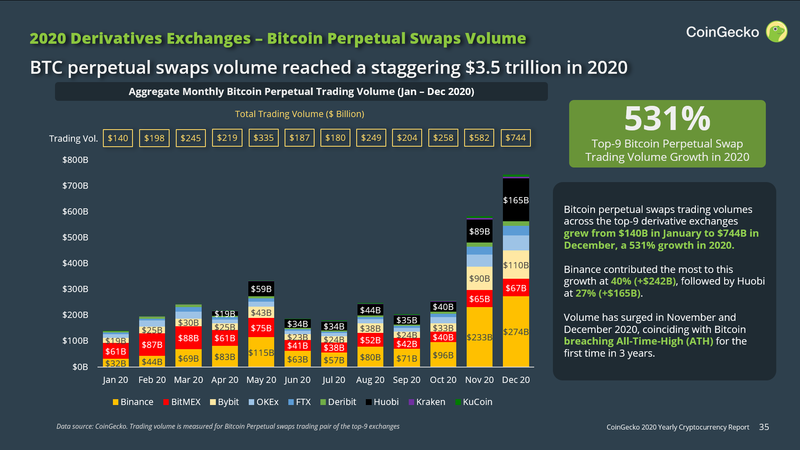

5. Bitcoin Perpetual Swap hit $3.5 trillion in volume as Bitcoin price recorded new ATH

1. Top 30 Cryptocurrency Market Capitalization ended the year with an all-time high of $732 billion

One of the main reasons for this 308% growth is the institutional entry into the market. Renowned investors including Paul Tudor Jones and Stanley Druckenmiller have been endorsing cryptocurrencies while large public listed companies such as Microstrategy and Square have been purchasing Bitcoin as part of their corporate treasury. This has led to a boost in crypto market confidence.

2. The 2020-2021 Bitcoin bull run appears to mimic the 2016-2017 trajectory

The 2016-2017 cycle saw the Bitcoin price grow and peak at 4,527% returns. Meanwhile, in 2020-2021, Bitcoin has risen more than double in the first year against the last cycle (303% vs 130%).

However, the difference this time is that the cryptocurrency market may be able to sustain high valuation largely in part to an influx of institutional adoption as well as a macro environment that encourages loose monetary policies. Additionally, there is higher accessibility to the market as companies such as PayPal and Revolut now allow retail investors to easily buy cryptocurrencies.

Will the current cycle continue and reach the same height as before?

3. DeFi ended 2020 with an all-time high market cap of $20.4 billion

Moving on, the DeFi sector saw explosive growth as DeFi dominance rose rapidly from 0.9% to 4.6% in the summer. During the same period, the market cap multiplied 12 times to reach $19.6 billion.

Additionally, the DeFi market cap ended the year with a new all-time high at $20.4 billion. Based on the mindshare that the sector has managed to capture, DeFi has the potential to continue growing in the coming years.

4. Exchanges’ trading volume grew by $403 billion in 2020

The top-9 centralized and decentralized exchanges grew by $403 billion (+307%). While CEXs do account for 93% of the year’s increase, DEXs still recorded a trading volume of $29 billion in December.

Although DEXs still have a long way to go before flipping the volume of CEXs, they still clocked an impressive 17,989% growth in 2020 alone and is 5.53% of that CEX’s trading volume.

5. Bitcoin Perpetual Swap hit $3.5 trillion in volume as Bitcoin reached a new all-time high

The top-9 Bitcoin Perpetual Swap trading volume saw hit $3.5 trillion (+531%) as the price of Bitcoin reached a new all-time high. Huobi has emerged as the surprising contender to Binance’s dominance in the arena. Despite its recent launch in 2020, Huobi ended the year by commanding 22% of the market share.

Final Thoughts

Wow!

2020 was definitely an exciting year for the crypto space and we’re so happy you could join us through all the ups and downs. Now, buckle your seatbelts because we are all in for a ride this new year!

Erina Azmi — is CoinGecko’s market research analyst. Current expertise is finance and crypto - DeFi. Previously in research consulting and often did market analysis.