DagangNews.com

DagangNews.com

Index Options of Bursa Malaysia and Korea Exchange: Non-Performing versus Out-Performing Contracts

IT is interesting to note that Bursa Malaysia and Korea Exchange have regulated futures and options. Index futures of both exchanges introduced in the same year of 1995 have been highlighted in last article that testified on non-performing KLCI futures as opposed to ouperforming KOSPI futures as documented by number of contracts traded daily.

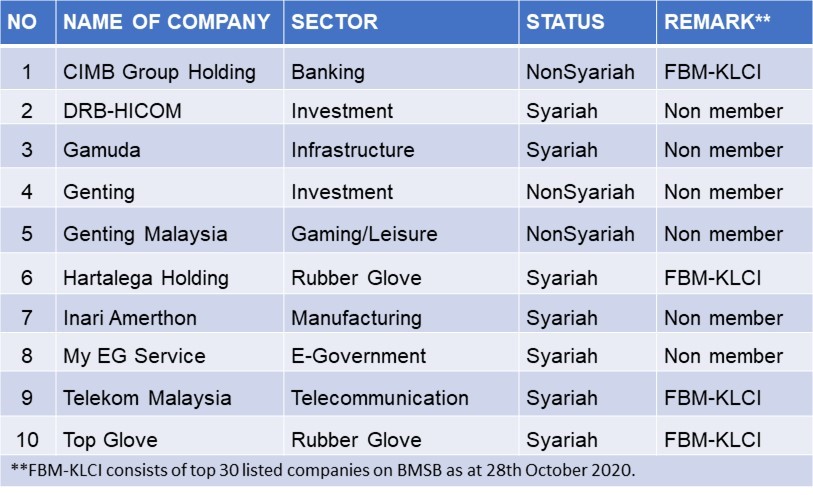

However, as promised last week, let us testify the trading of Single Stock Futures (SSF) that Bursa Malaysia Derivatives launched its first batch of 10 SSFs in 2006. This means the 10 selected companies of SSF are traded on Bursa Malaysia Securities Berhad (BMSB). However, SSF contracts have been revamped and refined accordingly in terms of the 10 listed companies on BMSB.

As such, they may or may not be constituents of 10 listed companies introduced in 2006 and may re-introduce in a current year. Back dated in 2006, the official index was Kuala Lumpur Composite Index (KLCI) consisting of 100 listed companies while the offcial index is now Financial Times Stock Exchange Bursa Malaysia (FBM-KLCI) comprising of 30 listed companies.

Profile of SSF Constituents

The scenario was documented by the following two tables as at 28th April 2006 and 28th October 2020, respectively:

Again, Single Stock (SS) futures trading looks also having disappointed performance with low liquidity due to the lack of active participation by institutional investors. SS futures we hope not to share in the near future on the natural deaths of rubber futures and tin futures in early 1990s.

Brighter Prospects of SSF by 2021?

We expect SS futures will become an important avenue for the local fund managers to use it for managing the volatility of 10 listed and selected companies on BMSB (Table 2). In fact we hope rich Muslim retail investors to manage the significant fluctuations of their syariah investments on seven SSF companies, notably the two big rubber glove manufacturers; Top Glove and Hartalega during the spikes of pandemic COVID-19 cases demonstrate volatility of their prices in which the former has a range of RM1.44-RM24.14 while the latter has RM5.33-RM20.04 for year 2020. Then only SSF will have sufficient liquidity with active and regular participations of local investors by 2020!

Index Futures and Index Options

As noted last week, Bursa Malaysia introduced FKLI futures in May 1995 as in the case of Korea Exchange introduced its KOSPI futures also in May 1995. Likewise, Bursa Malaysia introduced its KLCI options in 2000 while Korea Exchange introduced its KOSPI futures in 1983. However, Korea Exchange revamped its options trading by introducing the new KOSPI 200 futures in 2010.

Options as the name may suggest, are derivative securities that give the right but not the obligation for the buyer to exercise his right. As opposed to the futures, both buyers and sellers have the obligation to fulfil their contracts. In options, the buyer has to acquire the right to buy by paying a premium. However, premium is non-refundable should the buyer fail to exercise his right and hence it is a form of his initial investment.

The performance of KLCI Options and KOSPI Options

For KLCI options, as noted last week it has dismay performance since it was introduced in 2000 from KLOFFE (Kuala Lumpur Options and Financial Futures Exchange) to then MDEX (Malaysia Derivative Exchange) to now BMSB. Due to its under-performing, Bursa Malaysia in 2019 has introduced new and revised trade execution options for investors to promote a more profitable and sustainable trading in the equities market. The options would enable investors to navigate more efficiently through the equity market environment of BMSB.

Despite the concerted efforts by bursa operator, the OKLI trades in most cases very low contracts that shows the mentality of local fund managers for not using it as a hedging tool. This is justifiable because options will allow the fund managers to limit their risk exposure of their heavy portfolio. In other words, options have a limited loss when the market goes against their projection, while it has unlimited profit when the market favors them.

On the contrary, the trading of KOSPI 200 option has become a common obsession in Korea. Interestingly, the retail investors in Korea trading of the KOSPI 200 options have made the Korea Exchange (KRX) the third most heavily traded derivatives exchange in the world. In fact, KOSPI options just behind only CME Group (Chicago Mercantile Exchange and Chicago Board of Trade) and Eurex Exchange (Eurex).

KOSPI Options As Effective Hedging Mechanism

However, it is not only the Korean appetite for risk that makes the that one index option so popular among individual investors. In fact, from 2003 to 2008, it has superb performance as the index option monthly trading volume already increased from 5.6 million contracts to 183 million. These index options are relatively small, making them accessible to many people with a contract size is KRW 500,000 times the index price as opposed to KLCI options of the FBM KCI times RM50.

In August 2010, Korea Exchange formed a smart partnership with Eurex Exchange (Uerex). By June 2020, over 254 million Eurex KOSPI Options had been traded since inception. Eurex and Korea Exchange (KRX) both extended their global reach with a strategic partnership to provide their market participants with further trading and hedging opportunities for KOSPI 200 positions during core European and North American trading hours.

It is time for Bursa Malaysia to have collaborations with other prominent global exchanges including Eurex Exchange as it has with CME Group in 2009 for successful global palm oil risk management!

Pending on approval of the Budget 2021 by parliament Malaysia, we expect FBMKLCI is ready to break back to its high of 1,600 level and palm oil price to reach its high of RM3,500 per tonne, Malaysian economy is set to record quarter positive growths for 2021!

The writer was a former investment professor at UiTM until retired in 2016, a Fulbright fellow of US Department of State, Washington DC since 2011 and principal research fellow at Lamka Advisory since July 2020.