By Franklin Templeton

Introduction

Our outlook draws on our wide range of independent investment managers to deliver asset class insights. Each manager approaches the economic environment with a different lens and offers views to help inform your decision making.

As we look forward to the post-COVID-19 pandemic period, we see predictions of above-average economic growth globally, unprecedented fiscal and monetary economic stimulus, and increased likelihood of inflation. We are entering an economic environment never seen before. Broadly, the common themes from our managers are:

- Given the return to growth in global economies, we are more “risk on” generally.

- While the extended low interest-rate environment looks likely to continue, there are risks of inflation and rising interest rates.

- Alternative asset investments such as hedge funds and commercial real estate may provide diversification, some protection for volatile interest rates and inflation, and may offer a partial substitute for a portion of fixed income.

- Environmental, social and governance (ESG) awareness is increasingly vital for risk-management and for potentially better expected returns.

Several of our investment professionals discuss the implications across asset classes. They share how they are thinking about their strategies considering continued market uncertainty, whether the extended low interest-rate environment will continue, and where they see potential opportunities.

1. Alternatives help diversify

In this low interest-rate environment, alternatives such as hedge funds and commercial real estate offer opportunities to include investments that act differently than equity and fixed income. They may also perform well in an inflationary or rising rate environment.

Hedged strategies less sensitive to interest rates

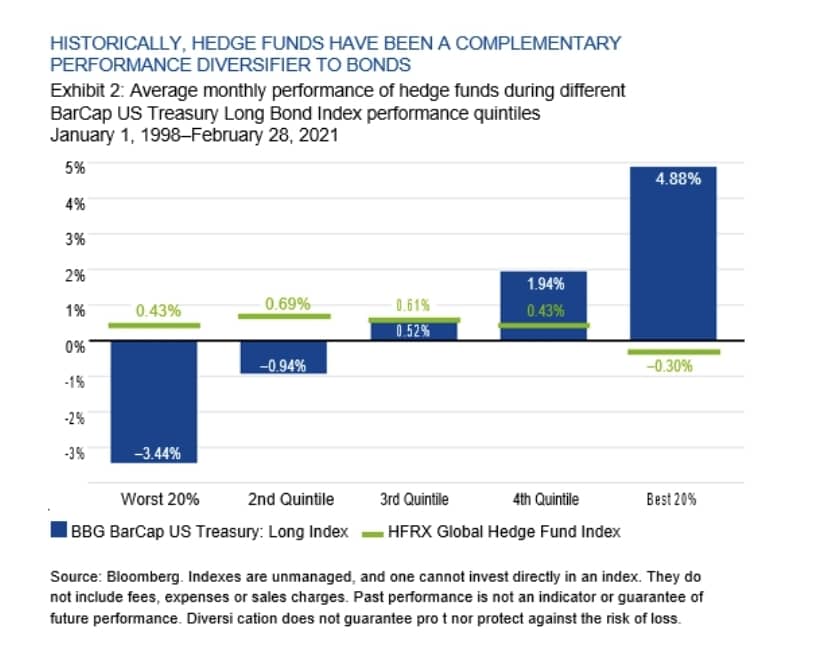

Hedged strategies typically have performed well in both rising and falling interest-rate environments. In particular, these strategies help to diversify one’s portfolio in a rising rate environment given the resultant increase in performance dispersion across regions, sectors and asset classes. Hedge funds have the opportunity to go long the potential beneficiaries of higher financing costs and short those areas hurt by them. We believe these strategies are particularly interesting now as a fixed income diversifier given the potential for renewed economic growth and an uptick in inflation.

While hedged strategies are designed to generate low volatility returns over the medium and long term, they also help to limit losses during various market shocks. For example, during the first-quarter 2020 COVID-19-related equity declines, the low equity sensitivity characteristics of a multi-strategy hedge fund portfolio helped a balanced portfolio of stocks and bonds to preserve capital.

With the availability of vaccines and improvements in the treatment of the virus, global economies are gearing to reopen. Many economists (and strategists) are discussing how a reopening may impact the equity and bond markets going forward. A large risk is the potential for a resurgence in consumer and industrial demand to push global inflation trends higher, and subsequent central bank responses. Any growth spurt and move higher in inflationary pressures should cause global interest rates to rise and bond prices to consolidate lower.

For now, this recovery scenario seems most likely. That said, if the virus was to mutate and the case count was to reaccelerate, markets may lower their concerns regarding growth-led inflation and the risk of higher interest rates.

Commercial real estate may be an inflation hedge

Real estate values held up better than expected during the pandemic, thanks to massive government intervention, better overall real estate fundamentals, and several outperforming sectors such as industrial, life sciences and rental housing. Looking forward in the United States, we are quite optimistic about real estate’s growth prospects in 2021–2022 because of the fast vaccination rollout, additional fiscal stimulus and robust consumer demand. Real estate is a derivative of economic expansion, and all property sectors are likely to benefit from the pent-up demand and coming jobs boom.

The risks to our outlook include possible new coronavirus variants and potential moderate inflation over the medium term. Inflation expectations have risen lately, and 10-year Treasury yields surpassed 1.6% in recent weeks, leading to financial market volatility.

Given a reflationary environment, income with growth should be an important part of portfolio allocation strategy. Historically, real estate as an asset class has shown to be able to hedge, at least partially, against inflation and rising interest rates largely because landlords generally can raise rents under improved economic conditions. Higher interest rates often link to better economic growth, which should lead to stronger demand for commercial space and higher income growth, offsetting the potential negative impact on financing costs.

2. All investing will eventually be ESG investing

Environmental, social and governance (ESG) factors are becoming increasingly important to investors, and the COVID-19 pandemic has been shining an even greater spotlight on them across the globe. While Europe is ahead of the United States in this area, new infra-structure and green energy initiatives are likely to accelerate the environmental component in the United States. We think all three aspects are critical, and that ESG is important to consider from both investment returns and risk perspectives.

In ESG investing, active experience matters

ClearBridge has long believed that all investing will eventually be ESG investing, that one day it will no longer be considered a separate discipline. Our experience has shown that integrating material and relevant ESG factors into fundamental research and investment decision-making has consistently added value to our investment process and supports our views as long-term shareowners.

Not surprisingly, as a result of the exponential growth of new investment strategies focused on ESG, there is corresponding growth in the risk of confusion and dilution of process. For many investment managers, the bulk of ESG analysis is outsourced — although no active manager would think of outsourcing the bulk of investment research. There is often a disconnect between ESG integration claims and practice.

For those struggling to make sense of ESG investment offerings, we recommend looking at the experience of the portfolio managers in managing assets with ESG factors, the history of the firm’s ESG investing, the ESG infrastructure, the investment process and track records over multiple business cycles.

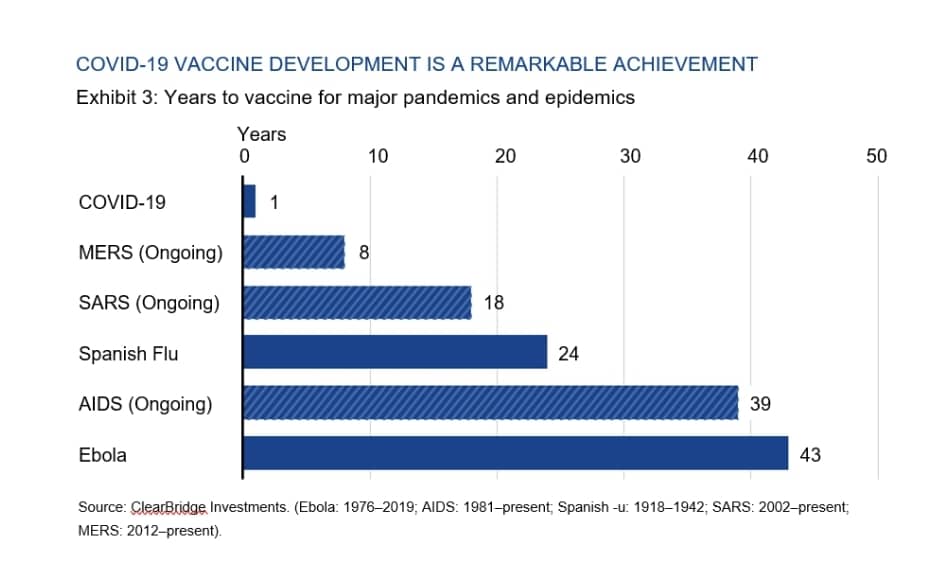

Stocks with strong sustainability profiles generally performed well in 2020 due to a variety of trends. We consider some of these to be secular trends that should support sustainability-focused investments for the longer term, such as helping fight climate change by lowering carbon emissions or overcoming resource scarcity through use of recycled materials. Another advancing trend—catalyzed by necessity due to COVID-19—was the effort of the health care industry to use its capabilities and financial resources to improve the welfare of society. The swiftness of development and the efficacy of the two initial COVID-19 vaccines reflect how biopharmaceutical companies’ drive to innovate treatments and cures has made meaningful advances possible not only for rare and genetic diseases, but also for infectious diseases and potentially cancer.

The sustainability winners over the next market cycle could include: discretionary names improving the sustainability of food sourcing and packaging; financials, which are prioritizing diversity and inclusion; and, industrials companies enabling energy efficiency and electric vehicles.

Looking ahead, we are positive on the long-term return potential for ESG portfolios. There are numerous studies documenting the long-term performance benefits of investing consistent with ESG principles. Depending on your time frame, there will be fluctuations in the market that may affect ESG-focused portfolios with less exposure to fossil fuels, for example, as oil prices change. We maintain a long-term view of market opportunities and returns but are watching how higher interest rates will play out across economic sectors and how variants of COVID-19 may delay full reopening in some parts of the globe. - DagangNews.com