THE overall stock market surged upwards on news that the National Recovery Council has proposed to the Federal Government to reopen Malaysia’s international borders as early as 1 March 2022 without the need for a compulsory quarantine period for travelers, visitors and migrant workers as long as they test negative for COVID-19 during their pre-departure and arrival at the country’s main entry points.

Nevertheless, the final decision will be made by the Cabinet.

As such, the benchmark KLCI rebounded sharply to end the week at 1,578.89 points, a sizeable 56.13 points or (3.68%) gain on a weekly basis. Gainers were led by the finance and travel & hospitality related stocks. I foresee some further upside for the market before it reaches the psychological 1,600 point barrier.

In a surprising development, Menara TM has been put on sale via expression of interest by its owner – Menara ABS Bhd and the closing date for the first stage is at 12pm on 18 March 2022. Realtors WTW Real Estate Sdn Bhd has been appointed to conduct the sale of the building.

The 55-storey office tower which has 989,000 sq ft of space, was officially launched in 2003 and cost RM669 million to construct. Telekom Malaysia said it was not involved in the intended sale and it is in the process of relocating its office to its own properties in Kuala Lumpur and Cyberjaya.

READ ALSO: Menara TM: The REAL story behind the sale of the landmark building

ECONOMY

Bank Negara announced that the overall GDP growth for 2021 came in at 3.1% after 4Q21 posted a 3.6% y-o-y growth. The result was in line but at the lower end of the government’s forecast of between 3% -4% for 2021.

Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz said the economic recovery is gaining momentum and the government is expecting the economy to grow between 5.5% - 6.5% for 2022.

Bank Negara expects both the headline and core inflation numbers for 2022 to remain moderate for the year. The average headline inflation for 2021 and 2020 were +2.5% and -1.2% respectively while core inflation stood at 0.7% and 1.1% during the corresponding periods.

Agriculture and Food Industries Minister Datuk Seri Ronald Kiandee said the Cabinet has agreed to provide a subsidy of RM0.60 per kilogram (kg) per chicken as well as RM0.05 per egg from all categories.

The purpose of the subsidy is to help ease the burden of poultry farmers following the increase in their costs (especially feed -which comprise almost 70% of their production costs) as well as hikes in logistics, labor, utilities and medicines and help to stabilize the price of chicken and eggs. The subsidy period will run from 5 February 2022 to 4 June 2022 and is estimated to cost the government around RM528.5 million.

The Department of Statistics disclosed that revenue for the services in 4Q2021 grew by 5.3% y-o-y to RM460 billion, primarily driven by the wholesale & retail trade, food, beverage and accommodation segment which grew by 5.1% to RM370.1 billion of the total value.

The remainder were mostly contributed by the transportation & storage segment (+8.2% to RM67 billion) and the private healthcare, private education & arts, entertainment & recreation segment (+6.5% to RM14.3 billion).

On an annual basis, the total revenue for 2021 was RM1.7 trillion which unfortunately still lags behind the 2019 revenue of RM1.8 trillion. However, the information & communication and the private health sub-sectors had managed to better their 2019 performance by 10.5% and 6.0% respectively.

Separately, the Volume Index of Services (VIS) for 2021 rose by 1.6% as compared to a 8.0% contraction in 2020. On a quarterly basis the VIS for 4Q2021 jumped 12.3%from a drop of 2.3% in 3Q2021, due to an uptick in the information & communication and the transportation & storage segments.

Malaysia’s unemployment rate fell to 4.2% in 4Q2021 with 687.600 persons unemployed as at end December 2021. The working population continued to increase marginally by 0.2% month-on-month to 15.65 million people. Those who are classified as active unemployed (ready to work & are actively seeking jobs) comprise 83.8% of the total unemployed numbers.

Those unemployed for less than three (3) months accounted for 55.9% while those who were unemployed for more than a year formed 7.6% of the total. The labor market is expected to continue to improve in the coming months as the economic recovery gains traction but we have to be aware of the potential pitfalls especially if a new virulent strain of Covid-19 emerges and necessitates the reimposition of movement controls.

Malaysia’s current account balance rose to RM15.2 billion in 4Q2021. This was due to the exceptionally high net exports of RM51.8 billion that was primarily attributed to the electrical & electronics, palm oil and chemical based products. The 4Q2021 net export numbers is the highest quarterly net export amount since 3Q2008.

Prime Minister Ismail Sabri said the National Affordable Housing Council has asked Bank Negara to review its financing model to ensure financial institutions ease financing requirements for the B40 and M40 segments to own People’s Housing Project (PHP) units and other affordable homes. Emphasis would be placed on direct purchase and rent to own options. He added that new PHP projects will also take into account elements like connectivity & internet access, public transport network and designs that are more economical and comfortable.

Bank Negara Governor Tan Sri Nor Shamsiah Mohd Yunus said financing models may need to be adjusted in light of the changes brought about by the Covid pandemic but nevertheless banks have been highly supportive of hose ownership with over RM60 billion worth of loans approved for first time house buyers in 2021 with over 60% of the amount for properties priced RM500,000 and below.

However, she stressed that house ownership could not be addressed solely by just the financing aspect and stressed that other areas such as dealing with the acute supply & demand mismatch, improving house price transparency and ensuring a vibrant rent market.

CURRENCY

The Ringgit was generally range bound against the US Dollar over the past two weeks. The Ringgit closed marginally higher at RM4.1880 / USD1.00 as compared to RM4.1807 in the previous week.

It posted a mixed performance over the week – gaining against the Yen and Euro but weakened slightly against the Singapore Dollar and British Pound during the week.

I am maintaining my view on for the Ringgit to trade at a tight range of between RM4.16 to RM4.21 with a downside bias in the coming week. This is on the back of rising expectations that the US Federal Reserve may be forced to raise interest rates faster than expected after the latest inflation numbers for January 2022 came in at 7.5% which surpassed expectations.

POLITICS

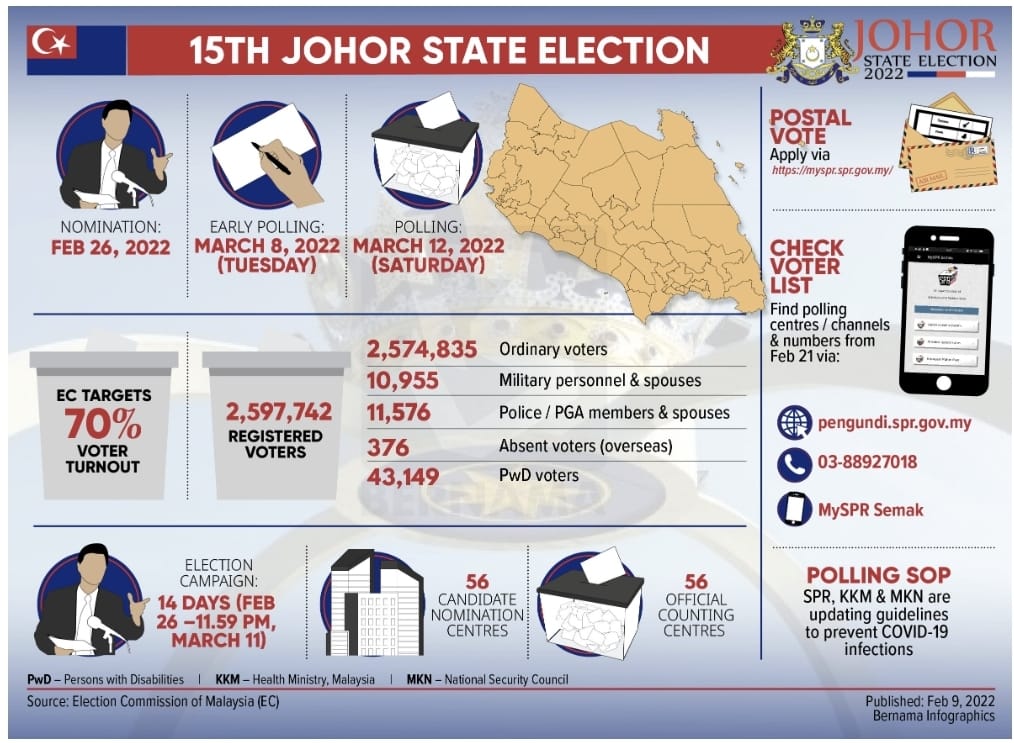

The Election Commission (EC) has announced that the nomination and polling dates for the upcoming Johor State Elections would be on 26 February 2022 and 12 March 2022 respectively. EC Chairman Datuk Abdul Ghani Salleh expects a 70% voter turnout based on a total of 2.59 million eligible voters in the state.

Malaysia United Democratic Alliance (MUDA) had reached an political co-operation agreement with DAP and Amanah to contest in six (6) seats (Tenang, Bukit Kepong, Parit Raja, Machap, Puteri Wangsa & Bukit Permai) at the Johor State Elections. MUDA is also currently in discussions with PKR to contest another three (3) seats in the elections.

Meanwhile, Parti Pejuang Tanah Air President Datuk Seri Mukhriz Mahathir said the party is planning to contest in 42 seats out of the 56 seats at the Johor state elections and will not be joining nor cooperating with any coalition at the moment. – DagangNews.com

Manokaran Mottain has been an economist with a number of financial institutions is now managing his own firm, Rising Success Consultancy Sdn Bhd