KUALA LUMPUR 8 March – Alchemy of financial markets has changed dramatically in the last 50 days.

The global economy is facing new challenge in 2022, possible nuclear war in the Eurasian region or Baltic. It is going to create huge drag on the global economy.

Chief Economist, Juwai IQI, Shan Saeed said Russia’s intrusion of Ukraine will bring great risks to the world economy that is still coping to recover from the COVID-19 pandemic shock.

“I can foresee three economic cost associated with this war where we can expect lower Gross Domestic Products (GDP), Commodities supply constraint and higher oil prices leading to deep recession,” he told DagangNews.com here today.

Shan was asked to share his views on the on-going crisis between Russia and Ukraine.

With sanctions imposed on Russia, Shan pointed the global economy can expect lower GDP growth of the country.

“It would harm Russia but not cripple the economy. Russian banks have been removed from SWIFT and most of the Russian banks have moved to China Border Interbank Payment System called CIPS.

“Sanctions would be counterproductive and impact cost to Europe in the long run,” he said.

Shan pointed that the commodities prices are already heading higher as Russia and Ukraine are major players in the commodities market .

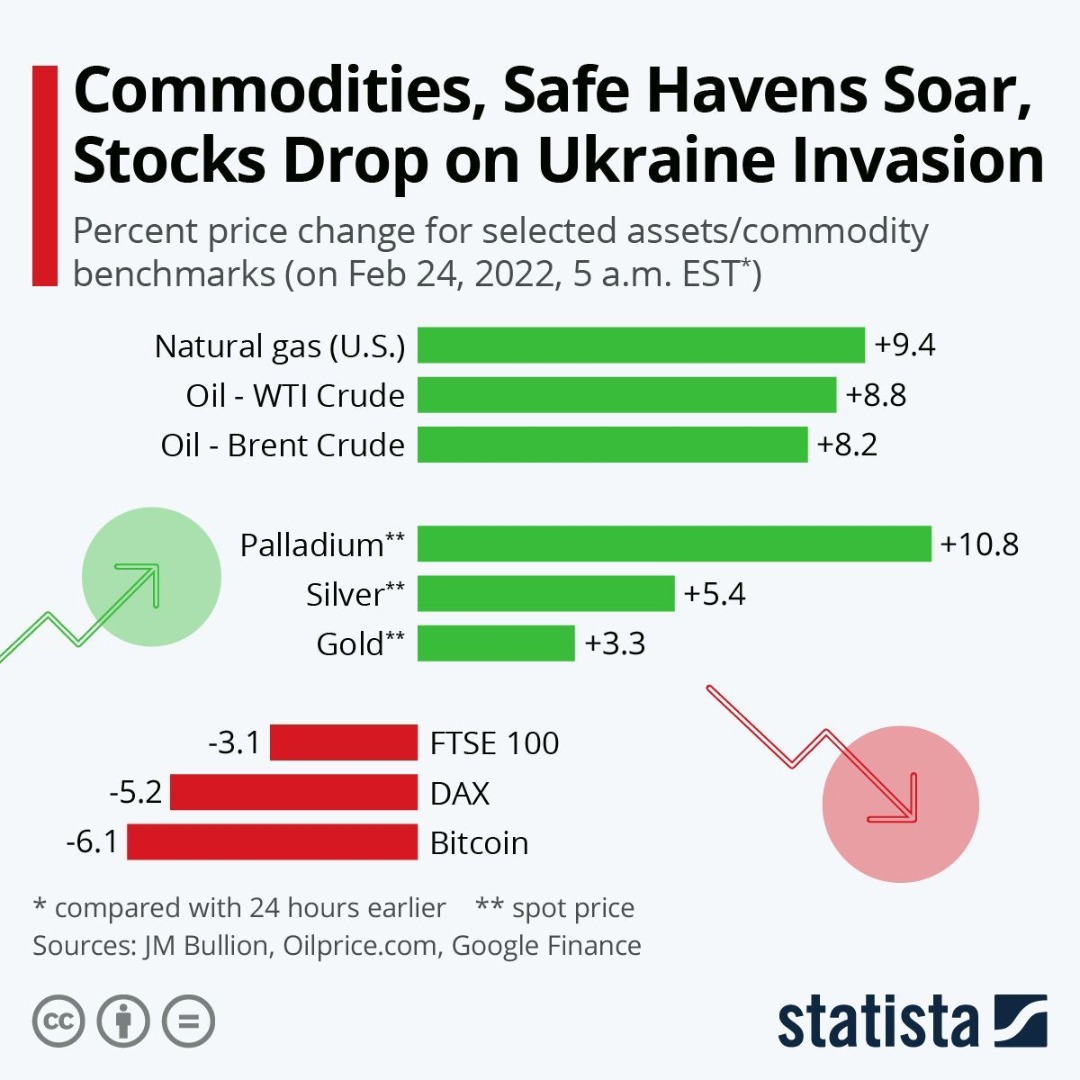

Just last week, he said the silver spot price even increased by 5.4 percent. Platinum and Palladium also rallied, gaining 3.7 percent and 10.8 percent, respectively.

The two latter precious metals are not only considered risk-averse investments, but are also major trade goods of Russia, whose exports are equal to around 15 percent of the world's platinum and more than 45 percent of the world's palladium production.

Wheat price up by 17%, Fertilizer prices up by 25% , Gas prices up 40% and Brent oil prices are up 48%.

Shan warned higher oil prices would drag the global economy into deep recession.

“Russia accounts for 17% in Oil and 11% share in the GAS market. Europe depends 50% on her oil and gas from Russia presently which is a huge number,” he said adding that agriculture and food inflation can be expected in the near term which can last longer than two years.

Natural Gas prices are up 20% in Europe and consumers are feeling the pressure. At IQI Global, we can expect inflation to hover around 6% Year-On-Year in Europe with consumers feeling economic repression.

Nevertheless, he said Malaysia is lucky enough, its economy is currently stable at the moment.

“Malaysia is not directly exposed to this war fortunately but can feel the impact if oil prices touch $200/ barrel if the war escalates further.

“Inflation can be expected as higher oil prices impact all asset classes globally and region. We expect global economy is heading to stagflation ie higher inflation and lower growth,” he said.

Shan said Bank Negara Malaysia has played its cards well and got plenty of room to manoeuvre in the monetary policy structure.

He said inflation can be controlled through effective monetary tool that is by raising discount rate and appreciating ringgit.

Shan stressed that BNM has got effective policy lever to control the price levels.

“Overall, BNM has performed a good job in terms of price, growth, and financial market stability in the last 5-10 years. Higher commodities prices, increased investment and strong consumption will keep GDP on the upsurge between 4 and 5% in 2022,” he added. – DagangNews.com