KUALA LUMPUR April 11 - When it comes to banks, Maybank, CIMB and Public Bank and RHB to name a few, comes to mind.

This is due to their presence in almost every towns in the country as well as their prominent brandnames.

But small but growing financial services group Malaysia Building Society Berhad is not to be outdone and is set to join the big boys.

Fondly known as MBSB, the lender stirred the market last week when it received the nod by Bank Negara Malaysia to commence negotiations with Permodalan Nasional Berhad.

MBSB was given the green light by the central bank to commence negotiations on it's plan to buy MIDF which is owned by PNB.

This move is part of MBSB's long term plan to become a full-fledged bank by buying MIDF.

If the acquition goes through, MBSB will be a complete banking services group with various financial offerings under it's house.

MBSB is a financial services group but not yet accorded with the banking status by Bank Negara.

MIDF is a financial services provider in investment banking, development finance and asset management.

MIDF or the Malaysian Industrial Development Finance was in talks with Saudi Arabia's Al-Rajhi bank last year.

Both entities planned to merge but the plan was scuppered.

MBSB shares were also the most actively traded stock on Bursa Malaysia last Friday.

A total of 117.49 million shares exchanged hands following the approval by Bank Negara for the company to commence negotiations with PNB.

The stock rose as much as four sen or 6.25 percent to 68 sen per share last Friday.

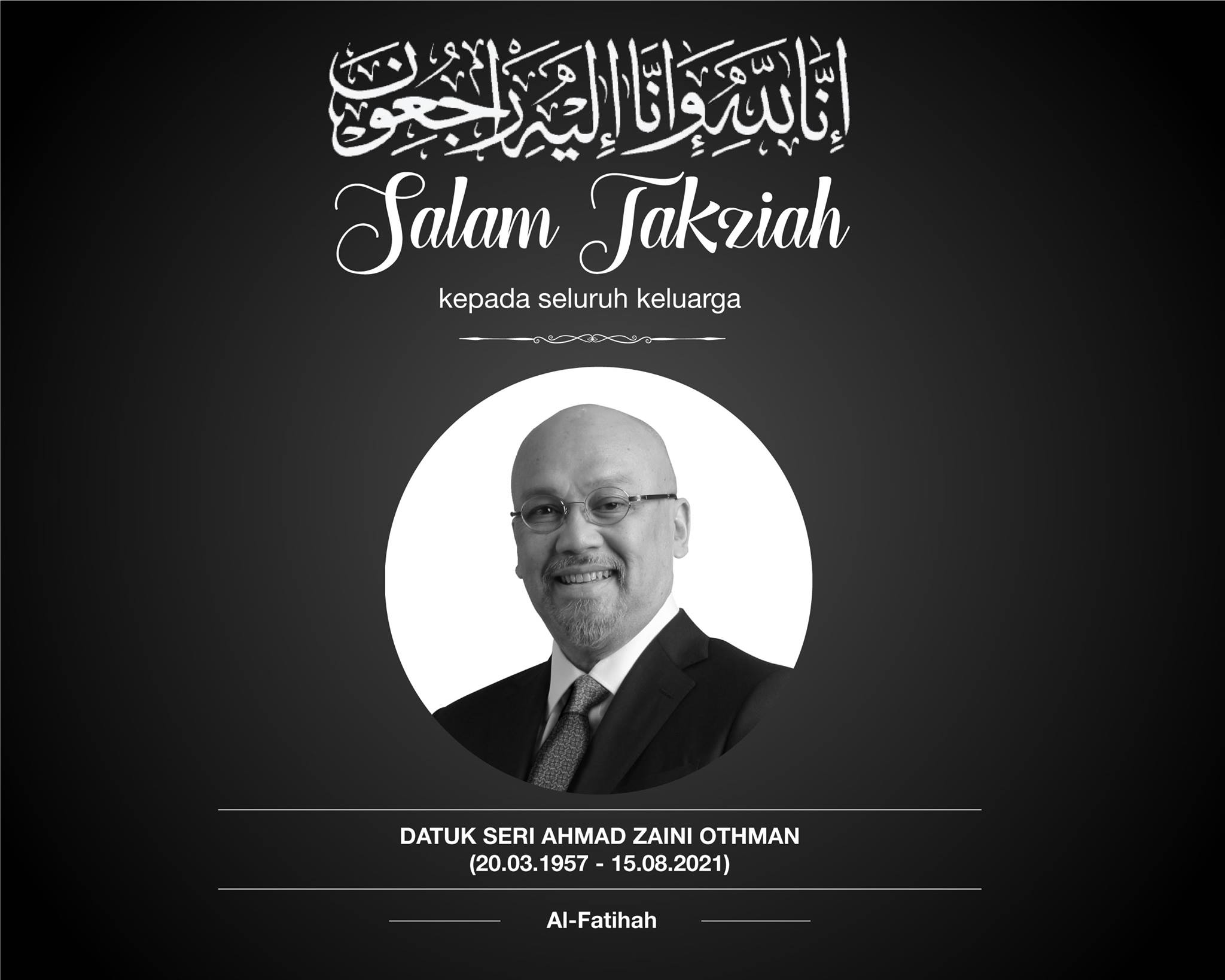

Meanwhile, it's been six months since the demise of it's late president and chief executive officer Datuk Seri Zaini Othman who died of COVID-19.

It is time for it's majority owner which is the Employees Provident Fund to find a replacement as soon as possible.

This is because is not good for a public listed group not to appoint an official CEO for such a long time as it may erode investors confidence.

It is understood that EPF has not found a suitable candidate as of now.

MBSB is now helmed by acting CEO Datuk Nor Azam Taib.

But whichever way, the new MBSB chief executive officer would have his hands full as he or she needs to handle the high impairments forked out by the group.

It is believed this is due to the high non-performing loans amassed by the banks as some of it's SME (small and medium scale enterprises) customers are unable to service their loans regularly due to the pandemic. - DagangNews.com