SHAH ALAM 15 Sept. - Maybank Investment Bank expect Overnight Policy Rate (OPR) to remain at record low of 1.75% until end-2021, but this is a “dovish pause” with policy bias tilted to easing rather than tightening.

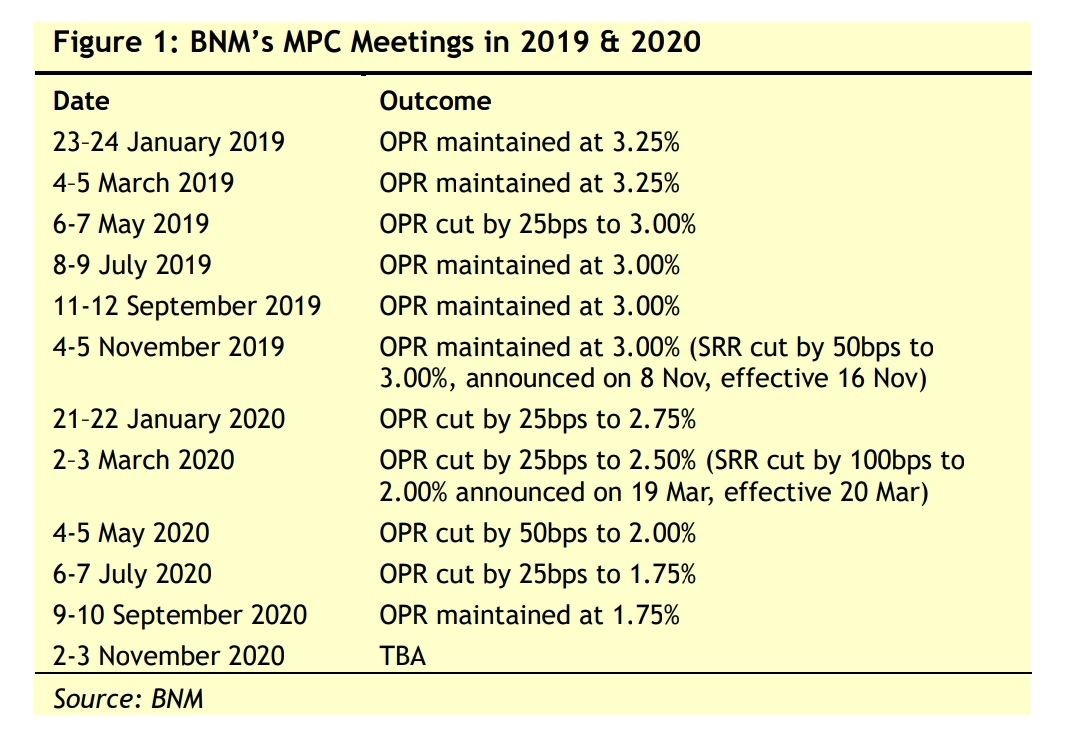

BNM kept OPR at 1.75% after the 9-10 Sep 2020 MPC meeting to preserve monetary policy space amid ongoing and upcoming non-monetary policy measures providing short-term reliefs and stimulus as well as for longer term recovery.

That includes RM295 billion economic stimulus package (~20% of GDP) that includes RM45 billion direct fiscal stimulus, plus Budget 2021 on 6 Nov 2020 and 12th Malaysia Plan (2021-2025) in Jan/1Q 2021.

"The decision also reflects signs that the recession worsened but bottomed in Apr/2Q 2020 with the prospect of shallower recession in 3Q/2H 2020 (Fig 3) that is supportive of the baseline forecast of recovery in 2021.

"Further, markets conditions have improved while monetary and financial conditions have eased. Stock market, bond market and Ringgit (vs USD) have improved from Mar 2020 selloffs.

"Monetary/financial conditions have eased as per our Monetary Conditions Index and financial conditions indicators like MGS - US Treasury 10-year yield spread, commercial banks’ average lending rate – 10-year MGS yield spread, and 10Y corporate debt – MGS yield spread,'' according to the bank's research report.

Apart from the impact of earlier OPR cuts, they also reflect impact of BNM’s liquidity injection since March 2020 which was RM43 billion from 100bps SRR cuts and flexibility in SRR compliance and RM9 billion from BNM purchases of MGS.

ASEAN central banks like Bank Indonesia and BSP have also kept their interest rate unchanged at their latest monetary policy meetings after >100bps cuts to-date.

"For now, we expect OPR to stay at 1.75% until end2021, but this is a “dovish pause” on downside risks thus continued policy easing bias implied by Monetary Policy Statement,'' the report said. - DagangNews.com