By ZAIDI ISHAM ISMAIL

[email protected]

It is extremely very cheap to go on holidays these days amid COVID-19. Holidaymakers can now opt to stay at hotel rooms at varying room rates. Hotel and resort owners are offering rooms to travellers at cut throat prices.

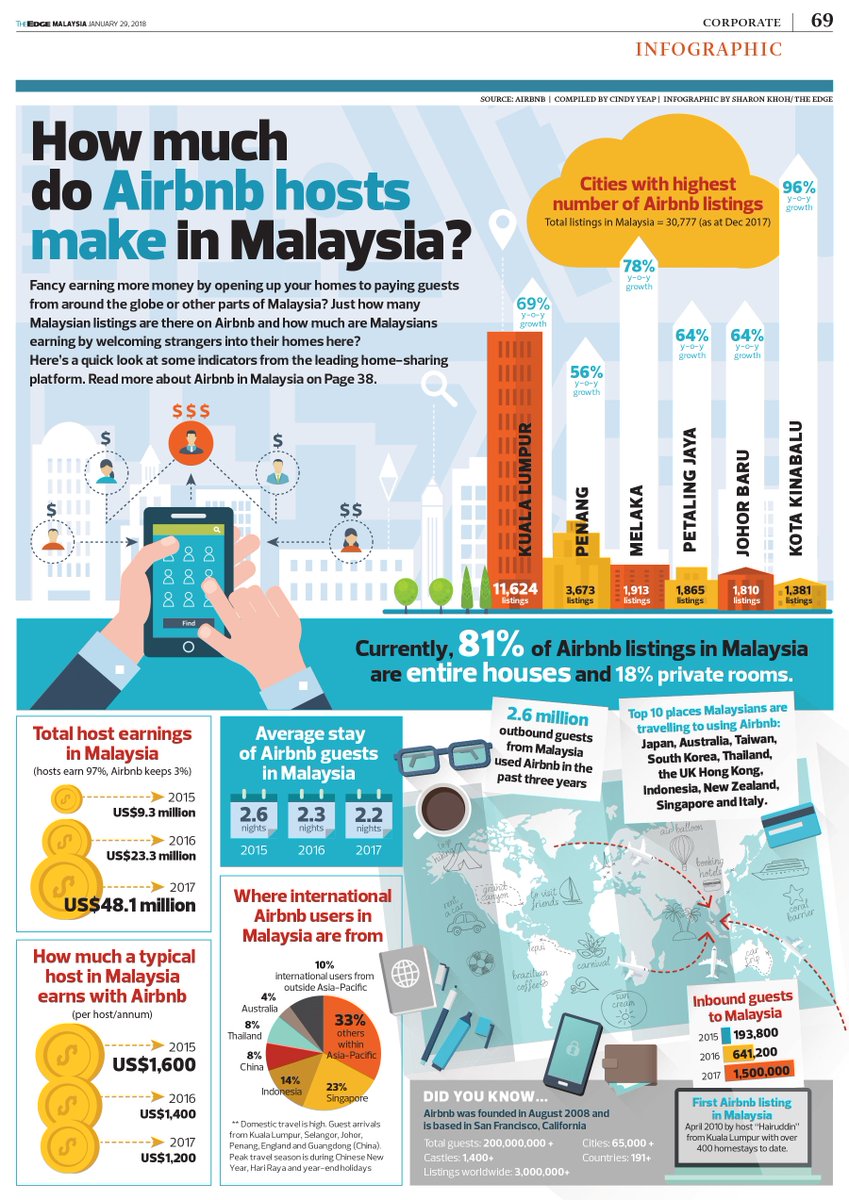

For those on a tighter budget, Airbnb are offering rooms, apartments or homes at even jaw dropping prices.

Now there is nothing wrong with all this as competition is good as it compels all service providers to extend the best services it can to customers.

However, the bonafide hotel operators and Airbnb are not competing on a level playing field.

Resort owners are subject to all sorts of regulations and licenses and they pay all sorts of tax. Airbnb however just rent out the premises on behalf of the property owners and get a cut from this activity.

Property owners meanwhile get paid free of any encuberances. Tax free. Is this fair?

Minister in the Prime Minister's Department (Economic) Datuk Seri Mustapa Mohamed was spot on when he said last week that Airbnb and its clients must register with the government so that it can be regulated.

Hotels and resorts have to pay land tax, corporate and other taxes as well as take care of its workers welfare while Airbnb just breeze through.

Airbnb cannot operate at its whim and fancy without being regulated.

For starters, Malaysian Hotel Association chief executivr officer Yap Lip Seng reportedly said Airbnb themselves do not compile the homeowners database who offer their homes for holiday makers.

Remember the tiff between Grab and the red and white taxi drivers? It was not an equitable situation at that time as conventional taxi drivers had to pay for their PSV (passenger service vehicle ) badge.

Things are much better now and the playing field is more level as more and more Grab drivers also have to sit for the PSV exam and the sector is at present much more regulated.

There was a time when Grab drivers were allowed to go scot free without applying for the PSV and enjoy making their income at the expense of the taxi cab drivers.

The hotel industry is subject to various tax regimes and thus it is not fair for the industry to taxed while Airbnb players are not.

State governments also impose all sorts of taxes on hotel operators such as the land tax as well as taxes and licenses requirements by the local councils.

Thus it is not fair for Airbnb to solely burden the already cash strapped tourism sector to face the burden alone.

Housing and Local Government Minister Zuraida Kamaruddin said that the government is not against Airbnb. In fact the authorities welcome Airbnb as it has the potential to help boost the tourism sector further alongside the existing hotels which are severely affected by COVID-19.

Airbnb has the makings of being a succesful holiday accomodation platform among Malaysians. But it must first toe the line. -DagangNews.com

The writer is former NST Business assistant editor.