WEEKLY MARKET ANALYSIS BY MANOKARAN MOTTAIN

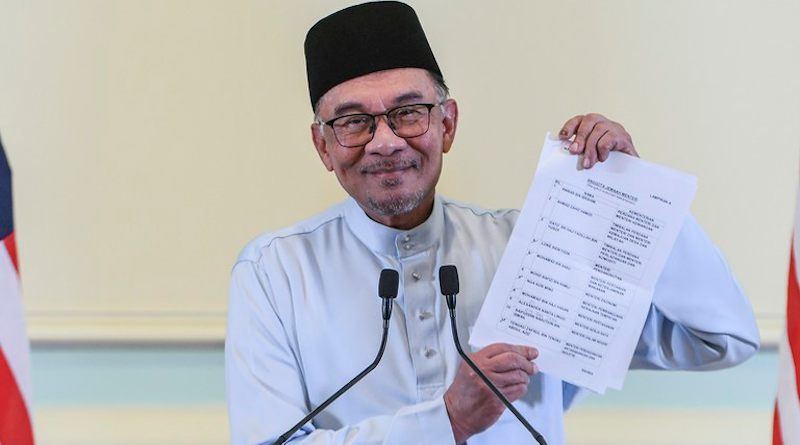

THE local equities market eased back slightly over the week following its huge rebound last week as the market participants settled down to await more details on the composition of the ministerial cabinet from Prime Minister Datuk Seri Anwar Ibrahim (DSAI).

The benchmark KLCI Index ended the week on a much stronger footing at 1,481.80 points (-4.74 points or -0.32%) as profit taking continued with investors taking locking in some trading profits ahead of the cabinet announcement.

In addition, the corporate result announcements over the past week had been relatively mixed with very few companies recording positive earnings surprises.

The new cabinet lineup comprising of two Deputy Prime Ministers and 25 Ministers had been sworn into office before the Yang Di-Pertuan Agong Al-Sultan Abdullah Ri’ayatuddin Al-Mustafa Billah Shah on 3 December 2022.

The two deputy prime ministers are Datuk Seri Dr Ahmad Zahid Hamidi (DSAZH) and Datuk Seri Fadillah Yusof (DSFY). In addition to their DPM roles, DSAZH and DSFY will also hold the Rural and Regional Development and the Plantation and Commodities Ministerial portfolios respectively. The new cabinet will hold a special meeting in Putrajaya on 5/12/2022.

Meanwhile, US bond yields continued its two-week slide as the market is looking ahead to the US Federal Reserve slowing down the pace of interest rate hikes going forward at its December 2022 meeting in the coming week.

This is despite the fact that the Labor Department reported that nonfarm payrolls increased by 263,000 in November 2022 with the unemployment rate standing at 3.7%. Hourly wages came in higher at 5.1% on a year-on-year basis which was well above the economists’ expectation of a 4.6% hike.

The 10-year UST yields fell by 20 basis points over the past week to 3.49% from 3.69%. This brings the total yield gains over the past 14 weeks to just 46 basis points.

The UST 2-year yields almost by a similar margin at 18 basis points to 4.28% from last Friday’s close of 4.46%. This brings the yield curve inversion between the UST 2-year and 10-year notes into its 21st consecutive week.

The yield spreads widened for the sixth consecutive week to -79 basis points from -77 basis points in the week before. The long-term average of the yield spread for both UST is +0.92% or +92 basis points.

The euphoria of a new government remains an attractive theme for foreign investors as we saw consistent buying activities in the local bond market as government bonds.

This resulted in rising prices and declining yields for the MGS with yields for the 10-year MGS bonds dropping by 8 basis points to 4.02% from 4.10% last Friday. The latest result widens the yield spreads between both countries’ 10-year bonds to 53 basis points from 41 basis points last week.

My view of the MGS movement remains unchanged at +/- 20 basis points from 4.25% in the near term, due to narrow yield spread against the UST.

ECONOMICS

The Securities Commission of Malaysia (SC) has disclosed that Malaysia’s digital assets market is well regulated to promote responsible innovation in the digital asset space and at the same time ensure the interests of investors are protected.

Currently there are four (4) registered Digital Asset Exchange (DAX) operators namely MX Global Sdn Bhd, SINEGY DAX Sdn Bhd, Luno Malaysia Sdn Bhd and Tokenize Technology (M) Sdn Bhd.

The DAX is an electronic platform that facilitates the trading of digital assets and allow investors to trade permitted digital assets such as Bitcoin, Ether, Ripple, Litecoin and Bitcoin Cash.

Malaysia’s regulated digital market is still relatively small with an average trading volume of around RM16 million per day.

CURRENCY

The Ringgit continued its rebound against the US Dollar for the fourth consecutive week as investors continue to pile into the Ringgit in anticipation of a revival of the country’s economic fortunes under DSAI.

In addition, investors have also started to lock in gains by the US Dollar in anticipation of the slowing interest rate hikes by the US Federal Reserve going forward. As such, the Ringgit ended the week higher at RM4.3830 / USD1.00 (+9.2sen).

The local currency generally strengthened against most of the other major currencies with the exception of the Japanese Yen which rose against the Ringgit by 5.2sen to RM3.2620 / JPY100.

The Ringgit rose for the third consecutive week against the Singapore Dollar RM3.2441 / SGD1.00 (+1.0sen), the British Pound at RM5.3924 / GBP1.00 (+1.2sen) and the Euro at RM4.6217 / EUR1.00 (+2.9sen).

MY OPINION

Now that the new unity government ministerial cabinet has been formed, it is time for new government to get to work to address the challenges ahead.

There are several concerns after the announcement, especially the Finance Minister’s post and Deputy Prime Minister I.

Consequently, the KLCI will likely ease further before edging upwards. The investors would have to digest the news and understand future directions.

In my opinion, YAB PM DSAI kept the finance post, because of the heavy lobby for the post. It is important to note his past experience in 1991-98 period.

He turned the fiscal deficit to surplus and managed to keep inflation around 3%.

Immediately after the GE15 winning and indication of him taking the key post as PM, ringgit and KLCI rebounded sharply.

Ringgit still high at 4.37 per USD at the time of writing. I am confident that investors will return to Malaysia sooner than expected, especially after getting the confidence vote on 19 December.

I also expect the benchmark KLCI to enter consolidation phase and re-test the 1,500-point level soon, which is then followed by the next resistance at 1,520 points.

However, to surpass the 1,520 points level, the local equities market will also need to be supported by a strong set of corporate results for 3Q2022.

For the currency market, I foresee the Ringgit to remain range bound between RM4.30 and RM4.40 against the US Dollar after chalking up gains over the past four weeks.

I would also expect similar performances by the Ringgit against the other major currencies as well given its strengthening trend over the past few weeks.

More concrete positive macroeconomic data will be need to nudge the local currency higher going forward, as the Ringgit has already shed most of the political risk premium attached to it. – DagangNews.com

Manokaran Mottain has been an economist with a number of financial institutions is now managing his own firm, Rising Success Consultancy Sdn Bhd